Germany PEO & EOR services

Germany offers a diverse range of PEO/EOR employment opportunities, attracting both domestic and international talent to contribute to its thriving workforce.

Employment contracts through PEO/EOR in Germany

One of the first things that an employment contract will outline is whether it is for a fixed term or for an indefinite duration (Befristete und Unbefristete Arbeitsverträge). In employment through a Germany PEO/EOR provider, the majority of contracts are indefinite as they provide more certainty for both the employer and the employee.

Generally, fixed-term contracts can be renewed a maximum of three times and can only last for a duration of two years. However, there are exceptions. If there is a justification for a longer term, for example, it may be possible for the fixed-term contract to be for more than two years.

EOR/PEO employment termination and notice period in Germany

Germany has no legal concept of “at-will” employment like in the US and generally has fairly strict legal requirements and procedures that German PEO/EOR employers must fulfil before successfully terminating employees. The minimum notice given to all employees is:

- Four weeks for less than two years of employment;

- One month for employment between 2–4 years;

- Two months for employment between 5–7 years;

- Three months for employment between 8–9 years;

- Four months for employment between 10–11 years;

- Five months for employment between 12–14 years;

- Six months for employment between 15–19 years;

- Seven months for service of more or equal to 20 years.

PEO/EOR employment in Germany: Salary, employer costs and working hours

In 2022, the average gross annual wage in Germany was $49.015,68. This is lower than the average annual wage in the United States: $53.490,00. As an employer through PEO/EOR in Germany, the actual employer costs are around 19% to 20% higher than the gross annual salary. Based on a $49.015,68 annual salary, the employment costs would be $58.328,66.

See all average salaries in Europe in 2024

The standard workweek is five days, eight hours per day, although a six-day workweek is possible. An employee may not work more than 48 hours in one week. Daily hours can be extended to 10 hours per day, provided that the employee does not work an average of more than 40 hours per week over a 24-week period.

Overtime is normally compensated with paid time off or with a higher hourly rate, but the exact rules for a given employer are normally set by contract or collective agreement. Board members and some management-level employees are often not paid overtime.

Paid vacation leave and public holidays in Germany EOR/PEO employment

Employees whose workweek is normally five days are entitled to 20 days of paid vacation per year. Employees who work six days per week are entitled to 24 days per year. The full vacation entitlement starts after an employee has been on the job for six months.

In Germany, there are 10 public holidays:

- New Year's Day – 1 January

- Good Friday – 29 March

- Easter Sunday – 31 March

- Easter Monday – 1 April

- Labor Day – 1 May

- Ascension Day – 9 May

- Whit Monday – 20 May

- German Unity Day – 3 October

- Christmas Day – 25 December

- 2nd Day of Christmas – 26 December

Maternity and paternity leave in Germany through PEO/EOR

An employee is legally entitled to 14 weeks of maternity leave (at least six weeks before and eight weeks after childbirth) if pregnant while working in Germany. In the event of premature birth, multiple births, or if a child is determined to have a disability, an employee is entitled to eighteen weeks of leave.

Find out everything you need to know about Maternity leave in other European countries.

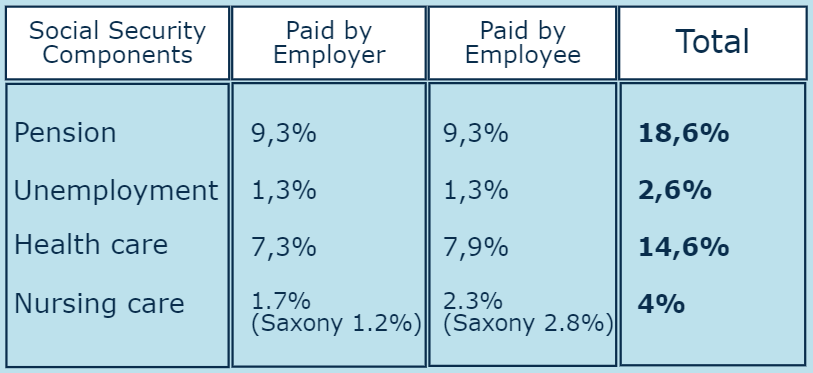

Social Security Contribution for PEO/EOR employers in Germany

Workers within Germany are required by law to pay social security contributions on their gross salary and all earnings in Germany. The following rates (2024) have to be applied against the gross salary, with the ceilings indicated.

Source: KPMG Germany

Source: KPMG Germany

To learn more about the social security tax in Europe, we invite you to read this article on Social Security Tax Rates for Employers Across Europe.

We know European markets

Europe is home to a diverse range of countries, each with its unique employment characteristics. These reflect the diverse economic and cultural landscapes across the continent.

Contact us

Get in touch with our team of experts to identify the best PEO and EOR solutions for your needs in Germany today. Our HR Outsourcing services provide you with the right helping hand to enable you to grow.

Monique Ramondt-Sanders

CCO & VP of HR Outsourcing

.jpg?)