Beauty & Personal Care Market: Insights into Europe's Thriving Market

The European beauty and personal care market is projected to reach US $143.30 billion by the end of 2023, with a steady annual growth of 1.62% from 2023 to 2028. The growth in the market is characterized by dynamic segments, evolving consumer preferences, and a shift towards online platforms.

The market can be broken down into skin care products and toiletries that are still dominating the European cosmetics market. Skincare alone reached a market value of 21.5 billion euros in 2020 compared to decorative cosmetics which account for only 9.4 billion euros. The luxury beauty segment witnessed significant growth in revenue in Germany and France, hence reflecting the diverse consumer preferences across regions.

This article will delve into the key trends, market structures, and notable insights shaping the beauty and personal care industry in Europe.

Personal Care Market in Europe: An Overview

The beauty and personal care market encompasses a diverse range of products that include cosmetics for lips, face, and eyes, skincare, fragrances, and other items for hair, and shaving. The market holds a significant position, contributing an estimated US$60.67 billion to the market volume in 2023.

The largest beauty and personal care markets within Europe are Germany, France, Italy, the UK, Spain, and Poland.

The European market for beauty & personal care in Euros, 2022

| Country | Market Value 2022 (Euros billion) |

| 14.3 | |

|

|

12.9 |

| 11.5 | |

| 10.5 | |

| 9.3 | |

| 4.5 |

Source: Personal Care Association - Europe, 2022

In the past couple of years, the industry witnessed a shift towards more sustainable and natural products. This has led to the rise of organic and eco-friendly personal care brands, as consumers become more conscious about the ingredients they put on their skin and their impact on the environment.

The digital revolution has been another factor that has transformed the way European consumers shop for personal care products. Online platforms and social media influencers have continuously played a significant role in shaping consumer preferences and behavior. E-commerce has become increasingly popular, offering convenience and accessibility to consumers across Europe.

Bonus Read: Unlocking the European Market: Finding Cleaning Products Distributors

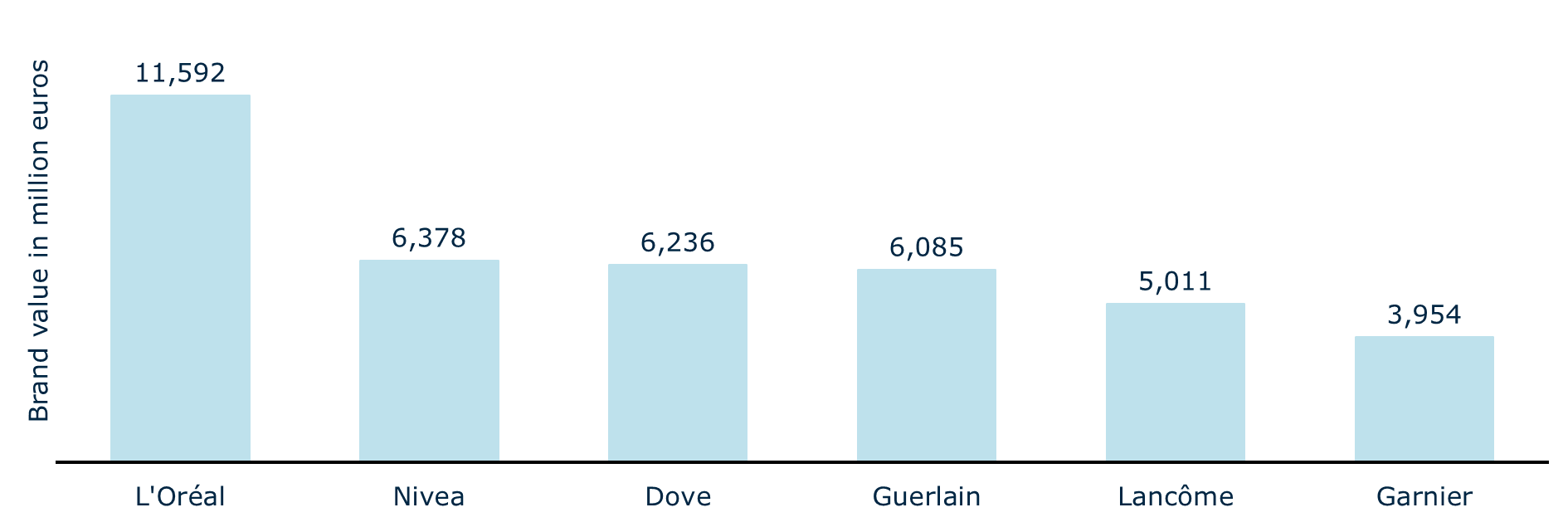

Ranking of the European leading cosmetic brands in 2023, by brand value

The European Beauty and personal care landscape is defined by the top 5 industry leaders.

- L'Oréal: As the industry titan, L'Oréal leads with an impressive revenue of $11.6 billion, symbolizing innovation and a diverse range of beauty products.

- Nivea: A skincare stalwart, Nivea secures its position with a revenue of $6.4 billion, embodying trust and effective skincare solutions since its establishment.

- Dove: Renowned for its commitment to real beauty, Dove generates $6.2 billion in revenue, promoting inclusivity and self-confidence through its diverse product line.

- Guerlain: Elegance and luxury define Guerlain, with a revenue of $6.1 billion, offering premium beauty products that epitomize sophistication and timeless appeal.

- Lancôme: Lancôme, with a revenue of $5 billion, stands as a beacon of French luxury, synonymous with high-quality skincare and beauty solutions that exude refinement.

- Garnier: Known for its affordability and effectiveness, Garnier, with a revenue of $4 billion, caters to a broad audience, making quality beauty products accessible to all.

Brand value of leading European cosmetic brands 2023

Source: Statista, 2023

Key factors influencing Consumer Preferences in the European beauty sector

While the USA is still leading globally for annual revenue generated for the personal care market in 2023, the European market stands out on the projected per capita spending of US$169.80 in 2023. Hence, it is important to closely align with your target audience and reasons why they might be inclined to buy certain products.

Rising Consumer Awareness

First and foremost, there has been increasing awareness about ingredients used in beauty and personal care products. Hence consumers are more informed about the potential risks associated with certain chemicals and are actively seeking safer alternatives. This has led to a demand for products with clean and transparent ingredient lists.

Social media and digital platforms

European consumers are exposed to different information and recommendations from influencers and beauty experts. These platforms have had a significant impact on the purchasing decisions. Currently, brands in the European market are continuously using social media and engaging with their target audiences to have a more competitive advantage within the market.

Sustainability and ethical consideration

For the past 10 years, sustainability has played a crucial role in shaping consumer behavior. On the European continent, more and more consumers are getting concerned about the impact of certain products and ingredients on the environment. As such, it is important to consider more eco-friendly and sustainable resources to become more competitive in the market. This goes beyond recycling packaging, cruelty-free formulations, and ethical sourcing of ingredients.

In countries like France, there is a surge in the demand for organic and natural beauty products. This trend aligns with the global movements towards clean beauty and reflects the evolving values of European consumers.

Convenience and accessibility

One of the factors that has pushed more consumers towards some products is the rise of e-commerce and online shopping. This trend has become more vibrant in the past couple of years due to the COVID-19 pandemic. Brands that offer easy-to-use websites, fast shipping, and hassle-free returns are gaining more popularity amongst European consumers.

According to research from Statista, online sales are anticipated to account for 20.8% of the total market revenue by the end of 2023, reflecting a shift in consumer behavior, influenced by social media and the convenience of e-commerce.

Also, Read: Learning from the PROs: European Tradeshows for Non-EU Manufacturers

Personal Care Market: Innovative Product Offerings

The European personal care market thrives on constant innovation, notably seen in the integration of technology into skincare and beauty devices in countries like Sweden and Denmark. From smart cleansing brushes to LED light therapy masks, these advancements offer personalized skincare solutions.

Another trend is the surge in clean and natural beauty products, responding to the increasing demand for eco-friendly options with plant-based ingredients and sustainable sourcing.

Personalized beauty experiences are on the rise, utilizing artificial intelligence and machine learning to analyze individual skin concerns. This results in tailored skincare regimens, including personalized serums and moisturizers.

Additionally, the market is embracing sustainability with the adoption of recyclable materials like glass and aluminium, reflecting a commitment to reducing environmental impact. These innovations reshape the personal care landscape, providing consumers in Europe with advanced and eco-conscious solutions for their beauty and skincare needs. This trend has become more common in Germany and France.

The beauty and personal care market in Europe is thriving, driven by dynamic market segments, evolving consumer preferences, and the influence of global beauty trends. With a projection of 143.30 billion by the end of 2023 and a growing emphasis on online sales, the industry remains the strongest player in the consumer goods sector.

For more information about growing your business in Europe, visit our sales outsourcing page

Related articles

-

Upcoming Aerospace & Defense Events + Paris Air Show Recap

Last updated: 18 July 2025Explore key takeaways from the Paris Air Show and discover what’s ahead in aerospace and defense at...

Read more -

People Analytics: Transforming HR for European Expansion

Last updated: 18 September 2024Discover how people analytics can transform HR management, aiding companies in navigating the...

Read more -

Navigating Retail Recruitment and Employment in Europe's Top Markets.

Last updated: 30 August 2024Explore retail recruitment and employment, labor insights, and strategic hiring approaches in...

Read more