Exploring the Veterinary Industry In Europe

The European veterinary market has grown to become the world's second-largest animal health market and is expected to increase by 6.4% between 2022 and 2027. The growth in the market is anticipated to be fuelled by rising pet adoption, the growing prevalence of animal diseases, and the increase in preventative care.

Pet owners in Europe have focused on improving the health and welfare of their animals, helping pave the need for veterinary healthcare services. Germany, France, and the United Kingdom are anticipated to foster growth in the market due to their sizeable pet population.

The need for veterinary healthcare services is anticipated to expand with the proliferation of pet food items and the increase in pet adoption rates. This article will explore the current developments in the European veterinary care industry and discuss the factors that are driving its growth.

European Veterinary Market

In 2021, Europe generated over 28% of the total global animal health market and became the world’s second-largest. According to the research analysis, the European companion animal healthcare market is expected to rise from its value of USD 3.96 billion in 2022 to USD 5.37 billion by the end of 2027, with a potential growth rate of 6.25% over the forecast period. Europe was in first place in pet food production worldwide in 2022, having 11,78 million metric tons, while North America had 11,2 million metric tons.

Pet healthcare

Pet life expectancy has significantly increased over the years due to the availability of effective medical treatment. Pet care drugs and medical procedures are generally associated with high expenditure. Pharmacies are likely to generate more than USD 14.2 billion in the European market by 2027 on account of an increasing number of animal surgeries.

The market is characterized by a wide range of products, including vaccinations, parasiticides, antibiotics, and others. The construction projects undertaken by European governments have enhanced veterinary care for animals and increased demand for veterinary vaccines.

Key players in the veterinary care industry in Europe

The biggest players in the veterinary care industry in Europe are Germany, France, the United Kingdom, and Spain. Germany is well-known for innovative veterinary research and development. It is home to many of the leading veterinary medication firms, such as Bayer, Pfizer, and others.

France is a significant player in the European veterinary care industry, placing a high priority on the health and well-being of animals. Numerous widely recognized veterinary research organizations and businesses are based in this country. The French Agency for Veterinary Medicines has been recognized for its development with regard to risk assessments and developments in the veterinary medicinal market.

Trends in the European Veterinary Industry

1. Rising demand for adoption

The primary factor contributing to the growth of the European veterinary industry is the rising animal adoption in European countries. There are already more than 140 million pets in Europe, and this number is anticipated to rise, according to a report by the European Pet Food Federation.

Pet owners want to ensure the health and well-being of their animals, which is driving demand for veterinary healthcare services. This number of pets at home can first be explained by the boom in the pet population, especially in Western markets during the pandemic.

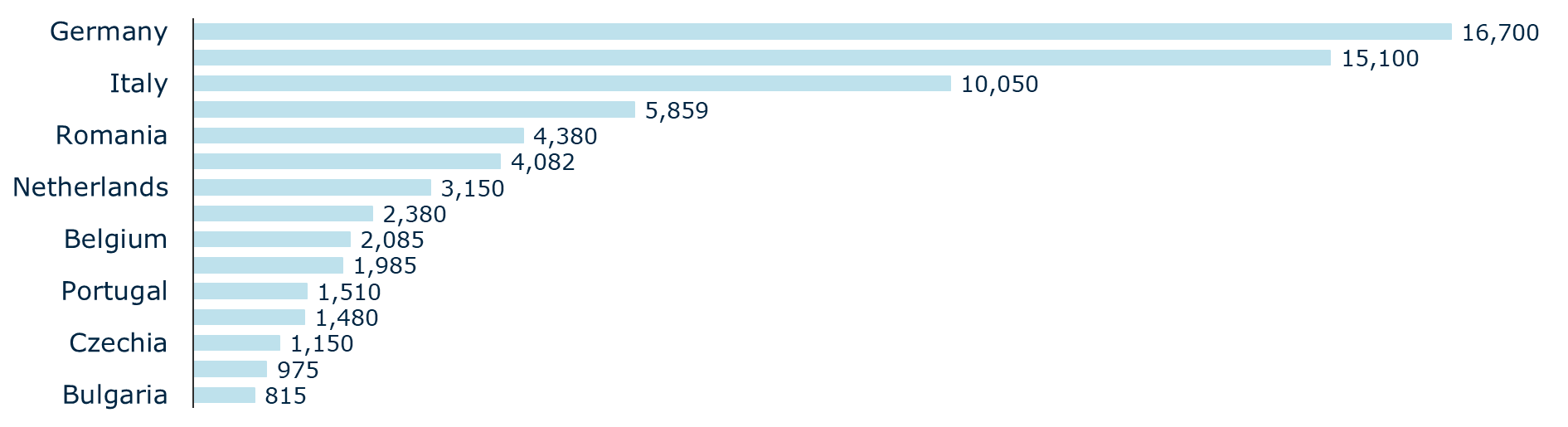

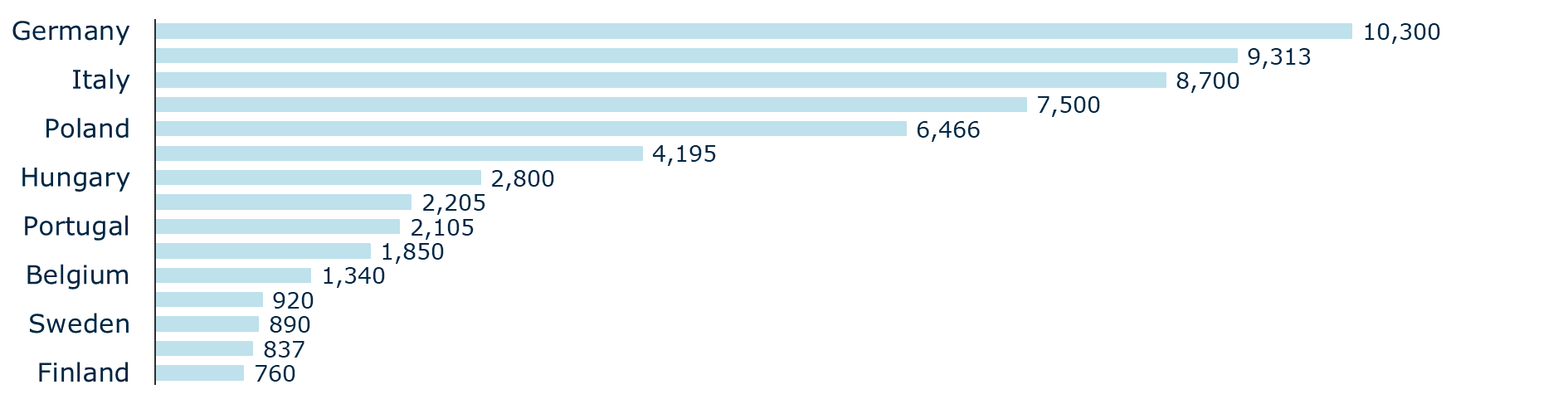

In Europe, the number of dogs and cats increased by more than twice the historical CAGR in 2020. Germany and Italy leading in the number of cats and dogs adopted by 2021, as identified in the diagrams below.

Number of cats in the EU in 2021, by country (1000s)

Source: Statista (2023)

Number of dogs in the EU in 2021, by country (1000s)

Source: Statista (2023)

Many Europeans who work from home or are socially isolated have adopted pets. The higher demand for pets spilt over into 2021, during which the pet population swelled further and is still showing strong growth in 2023.

In 2021, there were more than 83,600 cats and around 72,000 dogs in Europe. As a result of factors such as pet humanization and the quick adoption of pets in emerging nations. The trend is also anticipated to get stronger between 2023 and 2027.

2. Growing prevalence of animal diseases & increase in preventative care

It is anticipated that the overall expansion of the market under study over the forecast period will be fuelled by the rise in the prevalence of various animal diseases.

According to the published reports by the Department for Environment, Food, and Rural Affairs Animal and Plant Health Agency Advice Services, German authorities discovered a new outbreak of African swine fever in domestic pigs. Furthermore, according to a German study published in September 2022, diarrhoea affects 18.5% of the nearly 14,000 newborn calves examined from 731 German dairy herds, making it the most prevalent disease.

Therefore, the increasing emphasis on preventative care, which includes actions like immunizations and regular check-ups, is another market trend. Because it can help to lower the risk of disease and improve animal health outcomes, preventative care is becoming more and more significant in the veterinary healthcare sector. Preventive care services, such as immunization clinics and wellness programs, are increasingly widely available at veterinary hospitals and clinics.

3. The German Veterinary industry is Dominating

The demand for veterinary healthcare services in Germany is anticipated to increase as the country's pet population rises, propelling the market's expansion.

Germany has a total pet population of 27 million, of which 10.3 million are dogs and 16.7 million are cats, according to the FEDIAF Report 2021. According to Der Deutsche Heimtiermarkt, the number of mixed-breed dogs increased from 42% to 44%, which further supports the nation's expanding pet adoption rates. The need for veterinary healthcare services is projected to rise as a result of this trend, which is predicted to continue.

Along with the increase in pet adoption, Germany's pet food market is expanding quickly. According to a Global Agriculture Information Network report, Germany was a top market for pet food products, with 34.7 million pets and 83 million of the world's wealthiest consumers. The need for veterinary healthcare services in the nation is predicted to be driven by the rise in pet food product consumption and the expanding pet population.

Opportunities for North American Manufacturers

- Europe is the world's second-largest animal health market, which is generating

over 28% of the global market since 2021.

- The European companion animal healthcare market is expected to reach

USD 5.37 billion by the end of 2027, with a potential growth rate of 6.25%

over the forecast period.

- The biggest players in the European veterinary industry are Germany,

France, the United Kingdom, and Spain.

- The primary factor driving the growth of the European veterinary market is

the rising animal adoption in European countries, leading to an increase in

demand for veterinary healthcare services.

- The growing prevalence of animal diseases and the increasing emphasis on

preventative care is also contributing to the market's expansion.

- The demand for veterinary healthcare services in Germany is anticipated to

increase as the country's pet population rises, propelling the market's

expansion.

As pet owners continue to prioritize the health and well-being of their animals, the pet and veterinary market in Europe will continue to expand and innovate, providing better care and treatment options for pets and other animals. Therefore, it is one of the best markets to expand your business's operations.

Learn more about how we can assist you with it by exploring our Sales Outsourcing services.

Category

Related articles

-

MDR vs. FDA 510(k): Where U.S. Playbooks Break in Europe (and How to Fix Them)

Last updated: 2 March 2026Learn the key differences between FDA 510(k) and EU MDR, including classification changes, clinical...

Read more -

Expanding Non-Invasive Monitoring Tech into Europe: A Path for North American Innovators

Last updated: 26 August 2025Europe’s healthcare systems need scalable, non-invasive monitoring tools. Discover key...

Read more -

Navigating the European Market: Challenges and Opportunities for American Medical Companies

Last updated: 23 July 2025Europe’s medical device market offers huge growth potential for American MedTech companies, but...

Read more